All Categories

Featured

Table of Contents

In the event of a gap, superior plan car loans over of unrecovered cost basis will certainly go through ordinary earnings tax. If a policy is a customized endowment contract (MEC), policy loans and withdrawals will certainly be taxable as regular income to the degree there are revenues in the plan.

Tax obligation laws are subject to transform and you should seek advice from a tax obligation specialist. It's crucial to note that with an exterior index, your policy does not straight join any type of equity or set income investments you are denying shares in an index. The indexes readily available within the policy are built to keep track of varied segments of the U.S

These indexes are benchmarks only. Indexes can have different components and weighting methods. Some indexes have multiple versions that can weight elements or may track the effect of dividends in a different way. Although an index might impact your rate of interest attributed, you can deny, straight participate in or get dividend settlements from any one of them via the policy Although an outside market index may impact your passion credited, your plan does not straight join any supply or equity or bond financial investments.

This material does not apply in the state of New york city. Assurances are backed by the financial stamina and claims-paying ability of Allianz Life Insurance Coverage Business of The United States And Canada. Products are released by Allianz Life Insurance Policy Business of North America, 5701 Golden Hills Drive, Minneapolis, MN 55416-1297. .

Safeguard your liked ones and save for retirement at the same time with Indexed Universal Life Insurance Coverage. (IUL death benefit)

What is included in Indexed Universal Life Vs Term Life coverage?

HNW index universal life insurance policy can assist accumulate money value on a tax-deferred basis, which can be accessed throughout retired life to supplement revenue. (17%): Insurance policy holders can usually borrow versus the cash money worth of their plan. This can be a resource of funds for various needs, such as buying an organization or covering unforeseen expenses.

(12%): In some cases, the cash worth and death benefit of these plans may be secured from creditors. Life insurance can likewise help lower the danger of a financial investment profile.

How do I choose the right Indexed Universal Life Loan Options?

(11%): These policies supply the potential to gain rate of interest connected to the performance of a supply market index, while likewise providing a guaranteed minimum return (Indexed Universal Life calculator). This can be an eye-catching option for those looking for development potential with disadvantage protection. Capital forever Study 30th September 2024 IUL Study 271 respondents over 30 days Indexed Universal Life insurance policy (IUL) might seem complex at first, yet comprehending its auto mechanics is crucial to recognizing its complete capacity for your economic planning

If the index gains 11% and your participation rate is 100%, your cash money value would certainly be attributed with 11% interest. It's important to keep in mind that the optimum interest attributed in a given year is covered. Allow's state your chosen index for your IUL plan got 6% from the beginning of June throughout of June.

The resulting interest is included in the money worth. Some plans compute the index gets as the amount of the adjustments for the period, while other policies take approximately the day-to-day gains for a month. No interest is attributed to the cash money account if the index decreases rather of up.

What is included in Indexed Universal Life Accumulation coverage?

The rate is set by the insurance firm and can be anywhere from 25% to even more than 100%. IUL plans commonly have a flooring, frequently established at 0%, which shields your cash money value from losses if the market index does negatively.

This gives a level of protection and assurance for insurance holders. The rate of interest credited to your cash money worth is based upon the efficiency of the picked market index. Nonetheless, a cap (e.g., 10-12%) is typically on the optimum interest you can earn in a provided year. The portion of the index's return attributed to your cash money value is determined by the engagement price, which can vary and be changed by the insurance company.

Store about and compare quotes from different insurance policy firms to find the finest policy for your needs. Before selecting this kind of plan, ensure you're comfy with the possible variations in your cash money value.

How can Tax-advantaged Iul protect my family?

By contrast, IUL's market-linked cash worth development offers the possibility for higher returns, particularly in good market problems. This possibility comes with the threat that the stock market performance might not provide constantly secure returns. IUL's adaptable costs repayments and flexible fatality benefits give flexibility, interesting those looking for a plan that can advance with their changing monetary circumstances.

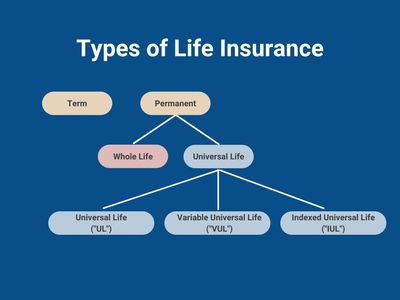

Indexed Universal Life Insurance Policy (IUL) and Term Life insurance policy are different life policies. Term Life Insurance covers a details duration, generally between 5 and half a century. It only provides a fatality benefit if the life insured passes away within that time. A term policy has no money value, so it can not be used to give life time benefits.

It appropriates for those seeking momentary security to cover certain financial commitments like a home mortgage or children's education costs or for service cover like investor security. Indexed Universal Life (IUL), on the other hand, is an irreversible life insurance policy policy that provides protection for your entire life. It is more costly than a Term Life policy due to the fact that it is developed to last all your life and supply an ensured cash payout on death.

What is High Cash Value Iul?

Choosing the right Indexed Universal Life (IUL) plan has to do with finding one that lines up with your monetary goals and take the chance of tolerance. An educated economic expert can be very useful in this procedure, leading you via the intricacies and ensuring your selected plan is the best fit for you. As you investigate buying an IUL policy, keep these key factors to consider in mind: Recognize how credited rate of interest rates are linked to market index efficiency.

As detailed earlier, IUL policies have different fees. Understand these prices. This establishes exactly how much of the index's gains add to your cash worth growth. A greater price can improve potential, but when contrasting policies, evaluate the money worth column, which will certainly help you see whether a greater cap rate is much better.

What should I know before getting Iul Growth Strategy?

Different insurers use variants of IUL. The indices tied to your policy will directly influence its performance. Flexibility is crucial, and your plan should adapt.

Latest Posts

Variable Universal Life Insurance Quotes

Universal Employee Life Insurance

What Is Indexation In Insurance